5 Simple Ways to Cut Your Household Bills

Posted 18th July, 2019

The Average UK Family Expenditure Statistics

First, let’s take a look at this data compiled by the Office of National Statistics, from 2017-18, where the average family's expenditure was broken down into the following categories:

- 14.1% on transport

- 13.3% on housing, fuel and power

- 13% on recreation and culture (package holidays, pets, gardens, newspapers, books etc.)

- 10.6 on food and non-drinks

- 8.7% on restaurants

- 7.6% miscellaneous goods and services (insurance, personal care, personal effects, other services)

- 7.1% on household goods and services (furniture, carpets, appliances, cleaning, tools, tableware)

- 4.2% on clothing and foot-ware

- 3.1% on communication (telephone, internet, post)

- 2.2% on alcohol and tobacco

- 1.9% on education

- 1.2% on health

- 13% on other expenses (holidays, interest payments, council tax, credit finances, fines)

Possibly a few surprises there for what they term ‘the average family’ and we all know that if this mythical average family exists somewhere it’s certainly not in our house!

Having created past budgets myself it was clear that each budget was created out of necessity at a time of major change – whether that was a relationship change, an addition to the family, a change or loss of job or having to move home.

Whatever your reason for needing to reduce your household bills the key driving factor must be that you seriously want to cut your bills and then honestly assess your current expenditure fully.

So How Do You Assess Your Current Expenditure Properly?

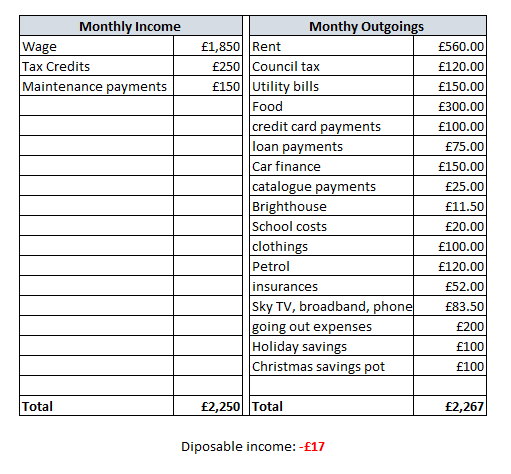

Quite simply just write down all your monthly finance incoming – whether it be wages, benefits, pension whatever the source in one column – then write down all your monthly outgoings in a second column.

Make sure the two lists are comprehensive; cover everything, not just the easily readable bills – everything!

Be sure to include your mortgage/rent payments, life/house/goods maintenance/property/car insurances, car payments, TV and internet packages, mobile phone packages, house/vehicle fuel, food, clothing, shopping, entertainment (drinking/smoking/eating out/lottery) – absolutely everything.

When you’re satisfied you have complete details, balance your incomings against your outgoings and this will give you a rough estimate of how much you ideally need to save each month – or if you are really lucky how much you can save each month.

That is the easy part! The hard part comes next. You need to decide which areas you are going to make the cutbacks in.

Initially this might feel as if you are making huge sacrifices, but in reality (if you take a step back for a moment) it is no more than a simple case of balancing the ‘household books’ and getting to grips with where your money is really being spent. So let’s get on to the tips.

1. Do You Have The Best Deal On All Your Expenditure?

For one moment let’s just assume that you’re going to keep your lifestyle as it is, without any major changes.

In order to find out of this is feasible, you need to run through all your different outgoing payment categories and check online with the various comparison websites you can find available for everything from car insurance to electricity.

Don’t just check one website, check several and see how the best they offer compares with what you are currently paying. If you see a saving, check the detail, make sure there isn’t any unrealistic lock-in period or penalty clause if you wish to change again in a year or so, then go for it.

There is every possibility that just doing this alone could save you well over £100 a year. I recently changed both my car insurance provider and home energy suppliers (gas and electricity) and those two changes saved me £250 for the coming 12 months – every penny counts!

2. Is There Room To Reduce Your Transport Expenditure?

As this is alleged to statistically be the single biggest drain on your finances maybe it’s time to see what the reality is for you.

If you have a car do you really need it? If you can walk, cycle, or take public transportation to work, or car share, then you may be able to save thousands of pounds each year on your car monthly payments (if you have them), fuel, maintenance, repairs, insurance, tax and vehicle registration. This can also help you to live a greener lifestyle on a budget!

Or, instead of getting rid of your car completely, maybe find a cheaper car option that is more affordable all round instead.

3. There Are Many Ways You Could Save Money On Food

It may not be the largest household expenditure but it is an area that is relatively simple to make savings in, especially when you consider that the average family wastes up to 30% of the food they purchase.

If you reduce your waste you will save money each month and this is quite easily done by adopting the any, or all, of the following tactics.

Eat more at home and not takeaways either – cook your own meals this saves dramatically. Plan your meals, buy more generic and store brand items, buy in bulk when they are on sale (f they are not a perishable item), use coupons, prepare meals ahead of time for days when you're too tired to cook, make extras of meals and freeze the extras, eat leftovers for lunch the next day.

Take-out and dining out can be a nice luxury and huge time-saver for a busy family, but the expense can be tremendous.

Even consider starting a vegetable garden if you have the space and time!

4. Have You Ever Considered Buying ‘Used’?

Why ever not? If you take timeout to visit a car-boot sale or your local charity shops you’ll be amazed at what you can find in great condition – much, not only cheaper but often, of better quality than from the ‘High Street’ or internet.

Online you can search on Gumtree and find many items that are hardly used being ‘discarded’ by friends, families and neighbours, much at rock-bottom prices and often for free just requiring you to collect.

Purchasing used furniture, clothing and much more allows you to save money on the things you are already buying.

5. Why Not Cancel All Your Memberships, Subscriptions and Have Fun For Free?

Do you have subscriptions to magazines or monthly boxes, gym or other club memberships? If so these soon add up to a lot of expense. Do you use them regularly or even need them? If you’re using a gym membership less than once a week you’re really throwing away money.

I recently encountered a colleague who, whilst complaining about their debt problems, in the same breath told me that they had a monthly family ‘fun’ budget of around £250 a month.

With a little thought you can have fun for free or on the cheap. Have you joined your local library? They have a stock of books videos and CD’s for free. Do you attend local community events like music festivals and art fairs? Are you aware of local volunteer groups and organizations?

So that’s my 5 top tips and I’ve steered clear of the usual suspects that normally get mentioned such as - consolidating your loans or debts if you have any, reducing your mobile phone tariff, change or totally delete your cable or satellite TV accounts in favour of Freeview and Netflix , move to a smaller home, rent out a room, install LED bulbs throughout the home, reduce the hot water and heating thermostat by a degree or two – all valid options worth considering as well.

The list really is endless once you apply your mind!