Compare our loans to other lenders here

Fast Loan UK representative example:

Borrow £300 for 6 months. 6 repayments of £84.58. Total amount payable £507.48. Interest rate: 138% pa (fixed). Representative APR: 835.85%

Why Choose Fast Loan UK for Quick Loans

Money Smart

We are committed to helping you with your money and all things that go beyond just quick loans.

Find out more about how loans work when you're self-employed in the UK.

What are the most common reasons loan applications get rejected?

.webp)

How to avoid clone Loan scams and report them

Help with your loan

Responsible Lending At Fast Loan UK

At Fast Loan UK, we understand there is a real need to lend in the most responsible manner possible. Besides our best lending practices that are outlined below, we have processes and controls in place to ensure that our customers never borrow more than they can afford to pay back. You can find out more about our responsible lending of quick loans in the UK and discover how we are a trusted fast loan direct lender.

HOW WE PROVIDE QUICK LOANS IN THE UK

We specialise in helping people with fast credit in the UK. We can ensure we will transfer any approved funds into your account as quickly as possible, helping you settle a short-term expense quickly. Once all relevant checks have been carried out on your application, you will receive the funds and be able to use them on the same day where possible. In fact, 95% of all our quick loans will credit your account within just 5 minutes of you digitally signing your loan agreement for fast loans.

We have specifically designed the borrowing process to be as quick and hassle-free as possible. We’ll ensure you won’t be kept waiting, leaving you with more time to put your new funds to good use and settle an unexpected or emergency expense fast.

HONEST & TRANSPARENT QUICK EASY LOANS

What you see is what you pay with Fast Loan UK, as we ensure your best interests are matched as a fast loan direct lender. You will have come across many other lenders offering a similar fast service online, but what makes us stand out is our attention to you personally. We want you to be safe in the knowledge that our service will consider your current affordability fairly and will not be solely based on your current credit rating. If we can see you can afford the financial commitment you’re requesting, this will help form a decision even if you have a low credit score.

We calculate the cost of your loan including each repayment upfront. This way you can see that we have no hidden charges and we do not believe in admin, fees either. We feel that it’s in both of our interests to treat you fairly when it comes to quick loans, and we promise you’ll NEVER get a nasty surprise from us.

TOTAL FLEXIBILITY FOR YOU

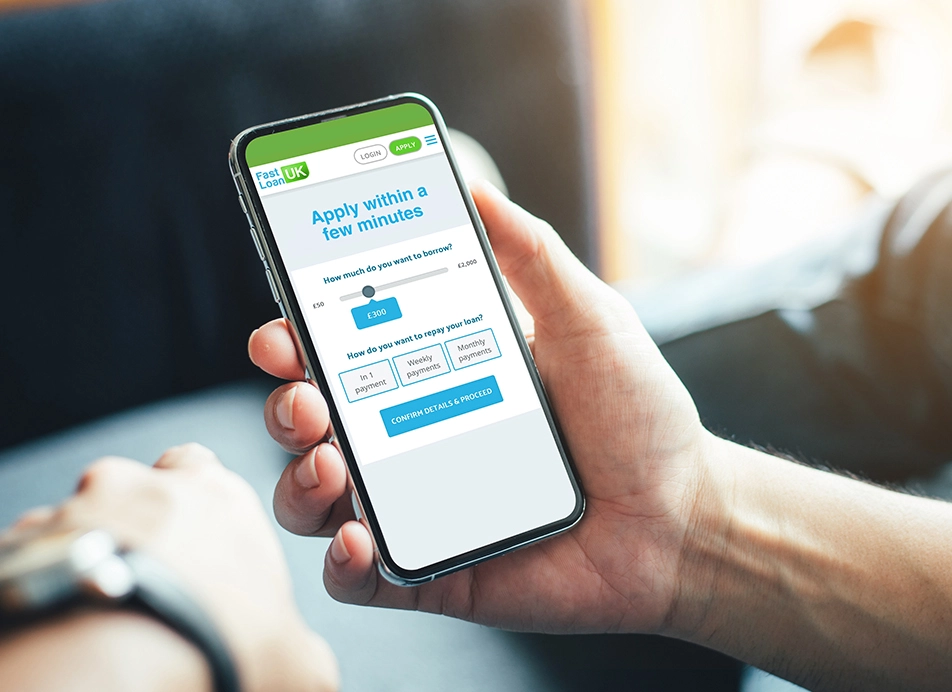

We provide total flexibility, so all you need to do is choose the quick small loans amount you would like to borrow, how long you would like to borrow for, and how many loan repayments you would like to make in that time. You can choose to repay your loan early if you can afford to, and you’ll only be charged interest for the days you’ve borrowed, plus a £20 early settlement fee (subject to the 100% cost of credit cap). Now that’s total flexibility that you won’t get from just any fast loan direct lender.

CHOOSE AFFORDABLE FAST LOANS

We’ve seen just how many payday loan companies do not provide flexibility with repayments. Instead, their customers commit to large one-off payments at the end of the month which may not be affordable.

As a result, we have developed quick easy loans that provide you with the option of making smaller weekly, fortnightly or monthly repayments. This means our fast loans will always be affordable for you, so just choose the repayment term you need of up to 8 months as a new customer, and we’ll do the rest.

FRIENDLY, PERSONAL APPROACH

Our friendly Customer Support Team is dedicated to giving you a personal touch whenever you need it. They’ll make sure you get the most out of our online service while being available to guide you through any questions or concerns.

At Fast Loan UK, we don’t see you as just a number. We know that everyone’s circumstances are different, and we’re here to listen. You’ll always have someone to talk to if you’re unsure about anything or run into a problem. If you need answers quickly, take a look at our FAQs — or get in touch with us directly.

UNDERSTANDING YOUR SITUATION

We understand that your circumstances can change unexpectedly from time to time, affecting your ability to manage bills and repay credit agreements. If this is the case, a Customer Care Manager will work with you to help resolve any financial difficulties you may have.

At Fast Loan UK, we are proud of the relationships many of our customers and Customer Care Managers have formed as a result of working together to resolve financial hardship. We want you to not feel alone if the worst-case scenario occurs, so just call, or email us to talk through your options.

Unlike many other direct lenders of fast loans in the UK, we do not believe in profiting from your missing loan repayments by charging excessive late and legal fees. We will work with you and give you every opportunity to repay your loan in a manner that is sustainable to the changes in your circumstances. The unexpected can happen at the unlikeliest times and we want to help see you through a difficult moment with our care and attention to quick loans.

APPLYING FOR FAST LOANS TODAY

If you want to apply for fast loans through us, we’ll be happy to help you today by completing our short application form. You will need to meet the following eligibility requirements first, including:

- Aged 18 years or over

- Current UK resident

- Be in Full-Time, Part-Time or Self-employment

- Receive a regular income

- Have a valid bank account and debit card

Meeting these requirements does not guarantee approval for our quick loans, with each customer subject to credit and affordability checks first. Through our affordability assessments we will need to evidence that the loan will be affordable and sustainable for you. If we cannot determine whether the loan will be affordable, we will have to decline your application.

Useful Information on Fast Loans

How are Quick Loans Assessed When I Apply?

Although all applications for quick money loans, along with individual circumstances, are considered, we have put in place screening processes to assess all customers’ creditworthiness. These will include using Credit Reference Agencies (CRAs) and Open Banking Providers where necessary. This is so we can ensure that you can afford the fast loans you request without being in any prior financial difficulty. This forms part of our decision process, and we will still consider your circumstances to ensure your best interests are met..

How Quickly Can I Receive a Decision?

We aim to give you a decision as quickly as possible. It should take you less than 5 minutes to complete your application online. As soon as you submit your application, we will run credit and affordability checks. If we require further information, we will let you know. Assuming there are no further queries needed to check with your application, we aim to credit your account within 10 minutes once approved, meaning a very fast turnaround for you.

What’s the Maximum I Can Borrow With Quick Small Loans?

We offer flexible fast loans up to a maximum of £2,000. If you’re a new customer, the maximum you can apply for on your first loan is £800. Once you’ve paid off your first loan with us in full, you will then become eligible to apply for up to a maximum of £2,000 on your next loan application with us (subject to full affordability assessment).

Please remember, whilst we are happy to provide loans up to £2,000, you should only apply for and borrow what you need. These loans are classed as High-cost Short-Term loans and are not suitable for repeated use over a short period of time.

Do I Have to Have a Credit Check Performed for Quick Loans?

Due to our commitment to Financial Conduct Authority (FCA) guidelines and responsible lending practices, a credit check is necessary to be able to approve fast loans in the UK. A soft search will be performed at the beginning of your initial application to ensure you can definitely proceed with a loan through us. This won’t show on your credit file so will not negatively impact your score. However, once pre-approved, a hard search will be performed and will show on your credit file as part of our decision-making process. Whether you’re a new or returning customer, we will perform a soft search to ensure nothing has changed in your circumstances. Remember, a credit search is designed to protect you as much as the lender, so that you can avoid unnecessary financial difficulty from borrowing more than you can afford. You can find out more about how it works, plus more information in our money smart blog.

Do I Need a Good Credit Score to Apply for Fast Loans?

Whilst having a good or excellent credit rating provides you with more options, it isn’t a necessity when applying for fast loans. We take a human approach to lending, so if you have a poor credit history, we may still be able to help you today. You will need to ensure the repayments and loan is affordable for you, and we’ll perform credit and affordability checks to determine this. Even if you have been declined recently or have a history of arrears, CCJs or defaults, we could still approve a loan. If you can demonstrate your financial difficulties are in the past and your current finances can afford the loan you need, we can look to help with affordable options.

What Should I Consider Before Applying for Quick Loans?

Applying for a loan shouldn’t be taken lightly, so to avoid any potential financial difficulties, there are a few things to consider before choosing quick loans. If you haven’t got a budget in mind, you should consider the exact amount you need and what this will cost to repay. You should also keep in mind that the longer the term you choose, potentially the higher amount of interest you will have to pay back.

Whilst you may be in an emergency situation requiring a loan fast, you should still ensure you have thought about how you will pay back the loan and if it is sustainable for you. If you have low affordability and will struggle to maintain the repayments needed, you should carefully consider if this is the best option for you. It’s best to work out how much you can afford to pay each month and stick to this budget.

Can I Pay a Loan Agreement Off Early?

Yes, if you can settle the loan amount before the end of the term, all you have to do is contact us. We can provide you with an early settlement quote that will include a £20 early settlement fee, and the interest charge over the term so far. This is subject to this not taking you over the 0.8% daily interest charge. If you can afford to settle early, this can save you money overall as you will only pay interest for the days that you borrowed. Just reach out to us and we will be happy to help.

What Are the Eligibility Requirements to Apply?

If you want to apply for fast loans through us, you will need to meet the following eligibility requirements, including:

- Aged 18 years or over

- Current UK resident •Be in Full-Time, Part-Time or Self-employment •Receive a regular income •Have a valid bank account and debit card

Meeting these requirements does not guarantee approval for quick loans, with each customer subject to credit and affordability checks first. We have no minimum credit rating requirement, so you will need to demonstrate the loan will be affordable and sustainable for you.

Do Fast Loan UK Charge Hidden Fees?

We are happy to confirm there are no hidden fees when applying through us. We believe in transparency when it comes to lending, so the full costs of the loan you require will be provided before signing any documentation. There are no processing fees and we also do not charge late payment fees either.

How Long Can I Choose to Repay Fast Loans?

We provide full flexibility with our loans, allowing you to choose the repayment term that is most suitable for you. If you are a new customer, you can choose up to 8 months for your loan term and choose either weekly or monthly repayments. You can use our loan calculator to see how much this will cost you, adjusting the term to fit in with what you can afford. If you are a returning customer, you may choose up to 12 months for repayments.