Responsible Lending

Our approach

We take our responsible lending obligations extremely seriously at Fast Loan UK. This is because we recognise the high risk nature of the product we offer. As a result, we have developed policies to minimise the chances of causing financial harm to anyone who borrows from us.

Our loan product has been developed to try and cushion our customers through any unexpected downturn in their financial circumstances. We do this by offering instalment loans over longer periods. This type of borrowing is different from your conventional Payday loans, as we are able to set smaller, more manageable monthly repayments, opposed to paying us back in one large hit when you next get paid.

Is a Loan from us right for you?

We want to ensure you are making the right decision when deciding to borrow from us. This is because our products are categorised as High-Cost Short Term Loans, and are a relatively expensive way to borrow. We are proud to be able to offer some of the less expensive short term loans on the market. However, there may be alternatives that are cheaper for you, for instance bank loans.

We also want you to be aware that borrowing from a short term lender will leave a search footprint on your credit file. This may act as a negative factor if you’re applying for a mortgage, or other long term loans, soon after taking out a High-Cost Short Term loan.

If you know that you aren’t going to be able to pay back a loan from us in full and on time, before you take out the loan - We strongly advise you not to do so. Missing payments and defaulting on our loans can have serious consequences. These may include negative marks on your credit file which may prevent you from taking out future credit agreement’s, including mortgages, credit cards, car finance, and other financial products.

Our Credit and Affordability assessments

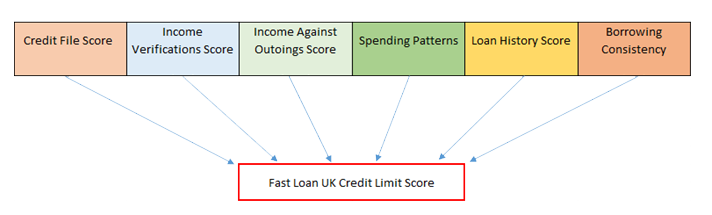

At Fast Loan UK, we do all we can to ensure customers don’t borrow more than they can afford. We use 6 measurable parameters to determine the affordability and suitability of a loan for a customer. The resulting scores from each parameter are used to determine a customer’s internal credit score.

This score not only sets a customer’s credit limit, but also determines the maximum length and minimum repayment schedule for any given loan.

A new customer's credit limit is initially capped at £600. This is because we like to build trust in our relationships before enabling them to take out larger loans. Existing customers can borrow up to £2000 subject to their credit limit score. Usually, this score will go up if they made all their payments on time with loans they’ve had from us.

Fast Loan UK will always use Credit Reference agencies to help us determine the suitability of a loan for a customer. Credit searches enable us to identify existing or settled credit agreements, as well as historic payment patterns. They also help us determine the credit risk and affordability of a loan for any given customer. In many instances, we will also use Open Banking data to help assess whether a loan is suitable. In our opinion, being able to see income and outgoings over a prolonged period is the best way to give a true overview of whether a loan from us would be affordable and responsible.

At Fast Loan UK, we don't see you as just a number. Many of our loan applications will go through to manual review. In these instances, we may request more information, but this means we are not blanket rejecting applicants based on raw data alone.