How To Improve Your Credit Score

Posted 22nd December, 2022

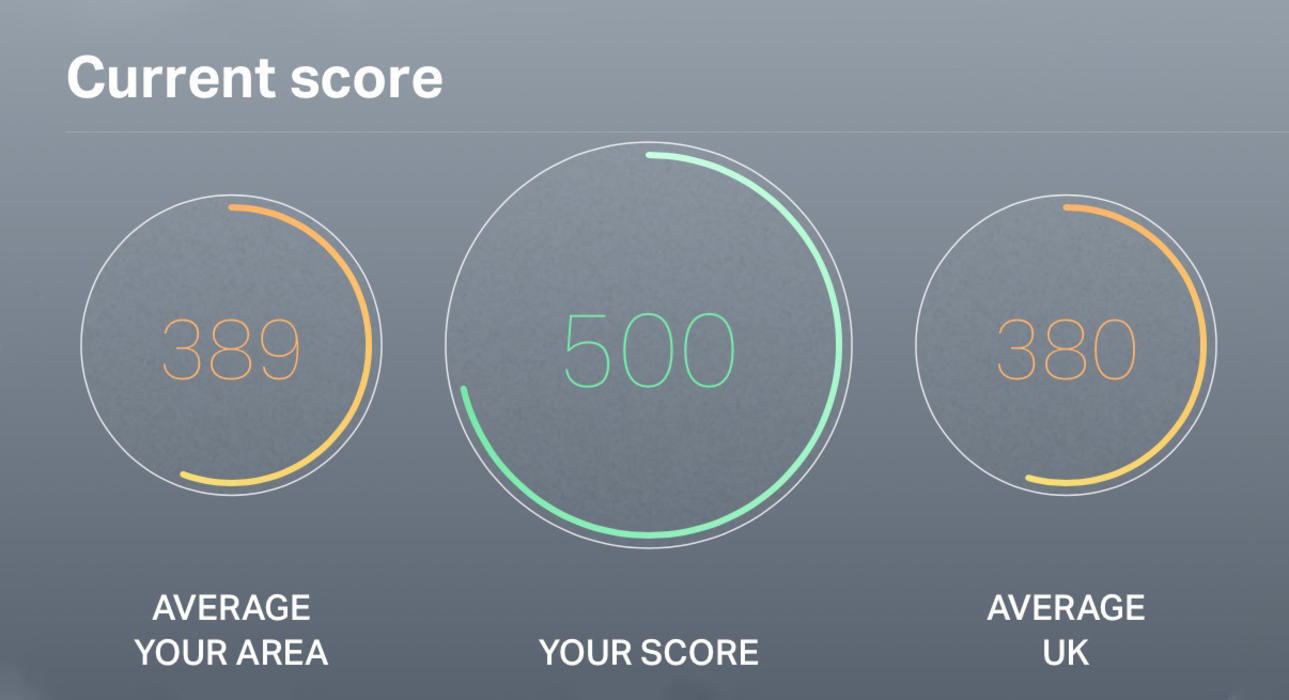

When it comes to applying for a loan, you need to have a relatively positive credit score for your application to be accepted. However, there are still ways you can secure the funds you need without having a good credit rating providing you meet the eligibility criteria and pass other checks. However, having a good credit score is beneficial beyond getting better interest rates, also helping you to access the best credit cards, housing options and insurance discounts. With that in mind, we’re taking a closer look at how to improve your credit score.

Double Check Your Credit Score

When it comes to improving your credit score, you will first want to check your credit report. There are a number of free ways you can check your credit report, each providing a unique set of data based on the information available. This information is likely to be pulled from different referencing agencies, hence the importance of requesting multiple reports. With this in mind, it’s beneficial to look for any mistakes as even the smallest of errors, such as a typo in your address, may negatively impact your score. If you do spot an error, be sure to report it straight away. By doing so, you can make sure your credit score is accurate.

Pay Your Bills On Time

By paying your bills on time, you’re essentially showing lenders that you can manage your finances, increasing the chances of your loan application being successful. It’s worth noting, however, that not all bills will count towards your credit score. With that in mind, it’s a good idea to identify those that are within your credit report to determine what’s actually impacting your rating.

With the cost of living rising each day, it may be beneficial to seek advice early on. A lot of companies will be able to provide you with an alternate payment plan based on your circumstances. So, even if they’re unable to provide exactly what you want, it may give you greater reassurance that you have more control over your finances and credit rating.

Joint Borrowing

Did you know that having a joint bank account may be impacting your own credit score? That’s right, the other persons credit rating may be negatively effectively your own, meaning that it’s lower than what it should be if you were to not have a joint account. Though it can be difficult to break away from these financial links, it can be entirely worthwhile, especially if you are applying for a loan, mortgage, or anything else that requires you to have a good credit score. By doing so, it can take as little as a month to get your rating back on track.

Avoid Applying For Further Credit

It can be tempting to apply for further credit if you have previously been declined, but it’s in your best interest not to. Instead of immediately applying elsewhere, give it some time. By doing so, you can make sure your credit score remains positive.

How Long Does It Take To Improve Credit Scores

When it comes to answering the question ‘how long does it take to improve credit scores?’, it really depends on your circumstances. For example, if you personally have a high credit score but you have a joint bank account with your partner and theirs is low, yours will automatically be deducted. Breaking away from that account will result in your credit score rising once again, sometimes in under a month.

Sometimes, improving your credit score isn’t as straightaway and will take slightly longer to get it back up. Having said that, if you proactively work towards improving your credit score, you are likely to see improvements anywhere between three and six months. This means making regular payments on time, building your credit file, and limiting how often you submit applications to set up new accounts.

For significantly low credit scores, it can take a lot longer to begin to see an improvement. In fact, it can take between one to two years to see a real difference. Though it can appear disheartening, consistency really is key to improve your credit score. Not only will being consistent with your finances help to increase your score, but it will [provide further financial advantages.

In Summary

With the New Year just ahead of us, now is the perfect time to start considering how you can improve your credit score. Though it may take sometimes, it’s worth doing in the long run, providing you with access to lower interest rates and greater lender options which can be very reassuring, particularly during times of need. More importantly, don’t be afraid of seeking financial help if you need it. We’re here for you.